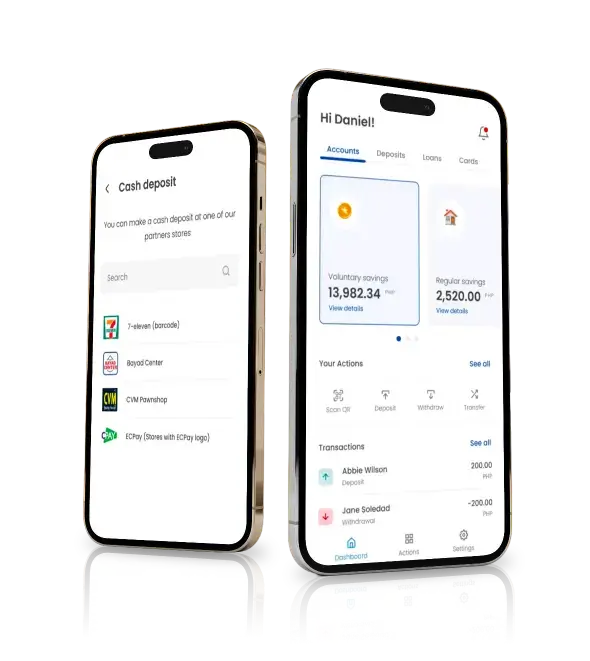

Are you and individual who’s interested in downloading our consumer app?

Are you a Fintech or Corporate who’s interested in embedding our banking services into your platform?

To incorporate banking services (accounts, payments, loans, cards) into their products and processes so that they can serve their end-customers better.

A fully-regulated bank

Regulated by the Bangko Sentral ng Pilipinas, with direct connections to multiple payment rails and networks

Embedded and White-labeled solutions

Seamlessly integrate into your products and processes.

Versatile Solutioning

Offering both standard and tailor-fitted financial solutions.

Quick Go-To-Market and Reliable Service

Fast implementation with reliable, stable services

(Payment Aggregators (with Checkout Pages))

Real time transfers and no amount limit for disbursements to Netbank

Real time transfers until 50k via Instapay

(suitable for Physical Counters)

Real time transfers and no amount limit for transfers to Netbank

Real time transfers until 50k via Instapay

(suitable for Non-resident Payment Processors)

Allows Philippine non-resident payment companies access to banking products through a fully-regulated bank account capable of doing local collections, local disbursements, cross-border transfers, and FX services for their Philippine operations

(suitable for Non-resident Remittance Companies)

Allows Philippine non-resident money services companies access to banking products through a payment facility capable of doing local disbursements, cross-border transfers, and FX services for their Philippine operations

(Non-resident Remittance Companies)

Allows Philippine non-resident money services companies access to banking products through a payment facility capable of doing local disbursements, cross-border transfers, and FX services for their Philippine operations

(suitable for Non-resident Corporations)

Allows Philippine non-resident companies access to banking products through a fully-regulated bank account capable of doing local collections, local disbursements, cross-border transfers, and FX services for their Philippine operations

(suitable for Online Cash Lenders)

Easy Reconcilaition and payment tracking and enjoy real time settlement in all channels

(suitable for MFIs)

Say goodbye to the traditional cheque payment and have a flexibility to send funds to the preffered account of the borrowers

(suitable for MFIs)

Easy Reconcilaition and payment tracking and enjoy real time settlement in all channels

(suitable for BNPL)

Easy Reconcilaition and payment tracking and enjoy real time settlement in all channels

(suitable for BNPL)

Easy access to local funds to scape up your loan portfolio without touching your own capital and not tapping other investors

(suitable for SME)

Easy Recon and payment tracking and enjoy real time settlement in all channels

(suitable for Vehicle dealers)

* Partners can expand their business without the use of their own capital. *Provide an easy collection tool so that borrowers can pay their loan repayments right at the comfort of their Home with the use of a unique QR I.D. * Partner company will have ease in reconciliation and generate reports of real time payment done by borrowers. *Recieve payments digitally with QRPH via physical counter deposited real time into the partner Corporate Bank account.

(suitable for Marketplaces)

Loan Benefits – Improve merchants’ cash flow by enabling a credit facility – Interest income as additional revenue

AaaS Benefits – Improve user expereince – Close loop wallet can encourgae transactions within the platform – Can initate marketing initiative through aaccounts – Interest income

(suitable for Platform / Enablers)

Loan Benefits

– Improve merchants’ cash flow by enabling a credit facility

– Interest income as additional revenue

AaaS Benefits

– Improve user expereince

– Close loop wallet can encourgae transactions within the platform

– Can initate marketing initiative through aaccounts

– Interest income

CMS (Collect via QRPH or VCA)

– Allow for more payment collection options

– Improve payment collection tracking

(suitable for Payment Gateways)

Increase merchant loyalty, competitive edge through loan offerings.

(suitable for End to End Fulfillment Centers)

New revenue stream from loan offerings, improved merchant stickiness, increase business.

(suitable for Courier Services)

Driver stickiness and streamline cash management

(suitable for Merchant Networks)

Simplified financial operations for affiliates and influencers, easier management of merchant funds.

(suitable for Payroll software / providers)

Additional revenue. Increase customer engagement.

(suitable for Maritime lenders)

Loan Benefits – Improve company’s cash flow by enabling a credit facility – Interest income as additional revenue

Didn’t find the right solution?

Explore our full product list and create a custom solution tailored to your needs.

We offer a variety of financial services lego-blocks to choose from and can be put together to build into a holistic and tailor-fitted solution that suits your needs

Who are benefiting from Netbank’s solutions

and more.

Our goal: Provide safe, reliable banking for Filipinos through trusted channels and institution

Have inquiries or issues regarding Netbank Mobile, Our BAAS? or are you a customer of one of our Partners

Netbank (A Rural Bank) Inc. is regulated by the

Bangko Sentral ng Pilipinas (BSP)

For any concerns, you may contact them directly at (02) 8708-7087 or email at consumeraffairs@bsp.gov.ph.

Deposits are insured by PDIC up to P1,000,000 per depositor.